capital gains tax services

8076563802 011 42427056 or E-Mail us at. Ad 5 Best Tax Relief Companies of 2022.

Capital Gains Tax What It Is How It Works And Current Rates

Web The maximum net capital gain tax rate is 20 percent.

. Short-term capital gains are gains apply to assets or. Ad Make Tax-Smart Investing Part of Your Tax Planning. Web The long-term capital gains tax rate is 0 15 or 20 depending on your taxable.

Web In 2020 the capital gains tax rates are either 0 15 or 20 for most. Web The withdrawal of capital from a family company through income. Web Capital Gains Tax CGT in portfolio investments has traditionally been overlooked by.

Web The freeze on the nil-rate band for inheritance tax has been extended to. Web Capital gains and losses must be separated according to how long you. Ad Register and Subscribe Now to work on Dividends Tax Worksheet 1040 more fillable forms.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Web 1 day agoThe measure deems securities in a non-UK company acquired in exchange. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Web Net capital gains from selling collectibles such as coins or art are taxed. Connect With a Fidelity Advisor Today. Web Call us at.

Tax filing status 0 rate 15. Web First under section 112A any capital gains under the value of 1lakh is. 4 1 See more.

Web Short-term capital gains STCG are incurred when an item that is held for. The rates for tax years 2021 and 2022 are shown in the tables below. Learn More About American Funds Objective-Based Approach to Investing.

End Your Tax Nightmare Now. Web 2022 Long-Term Capital Gains Tax Rates. The tax you pay on.

Web For example if youre single with a taxable income of 40000 in 2022 you. Ad Make Tax-Smart Investing Part of Your Tax Planning. Web If youre reporting gains on property using a Capital Gains Tax on UK property account you must include details of your gain and any tax youve paid in your tax return.

Web You must report all 1099-B transactions on Schedule D Form 1040. Web Non-domiciled individuals will now pay tax on gains or income received. Web For the 20222023 tax year these tax rates are 10 18 for residential property for.

Edit Sign and Print Tax Forms on Any Device with pdfFiller. Web Short-term capital gain tax rates. Connect With a Fidelity Advisor Today.

The profit on an asset that is sold less than a year after it is purchased is generally tThe same generally applies to dividends paid by an asset which represent profiA different system applies however for long-term capital gains.

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Capital Gains Tax Accountant London Pro Tax Accountant Capital Gains Tax

Capital Gains Tax Tax Tuesday The Tax Club Oau

Capital Gains Tax Uk Services Support Pkf Francis Clark

Capital Gains Tax What S The Big Deal What Are The Exclusions Finglobal

Menimbang Penerapan Capital Gains Tax

Business Establishment Services Tax Services Of An Accountant In Phnom Penh

Capital Gain Dependent Vs Independent Services Other Income Ppt Download

Capital Gains Tax Service Capital Gain Tax Service Pranav Kumar Gupta Jammu Id 24286560230

Capital Gains Tax System In Nepal An Overview Corporate Lawyer Nepal

Capital Gains Tax Return Consultants Advisors Accountant Specialists

Real Time Capital Gains Tax Service Taxscouts Taxopedia

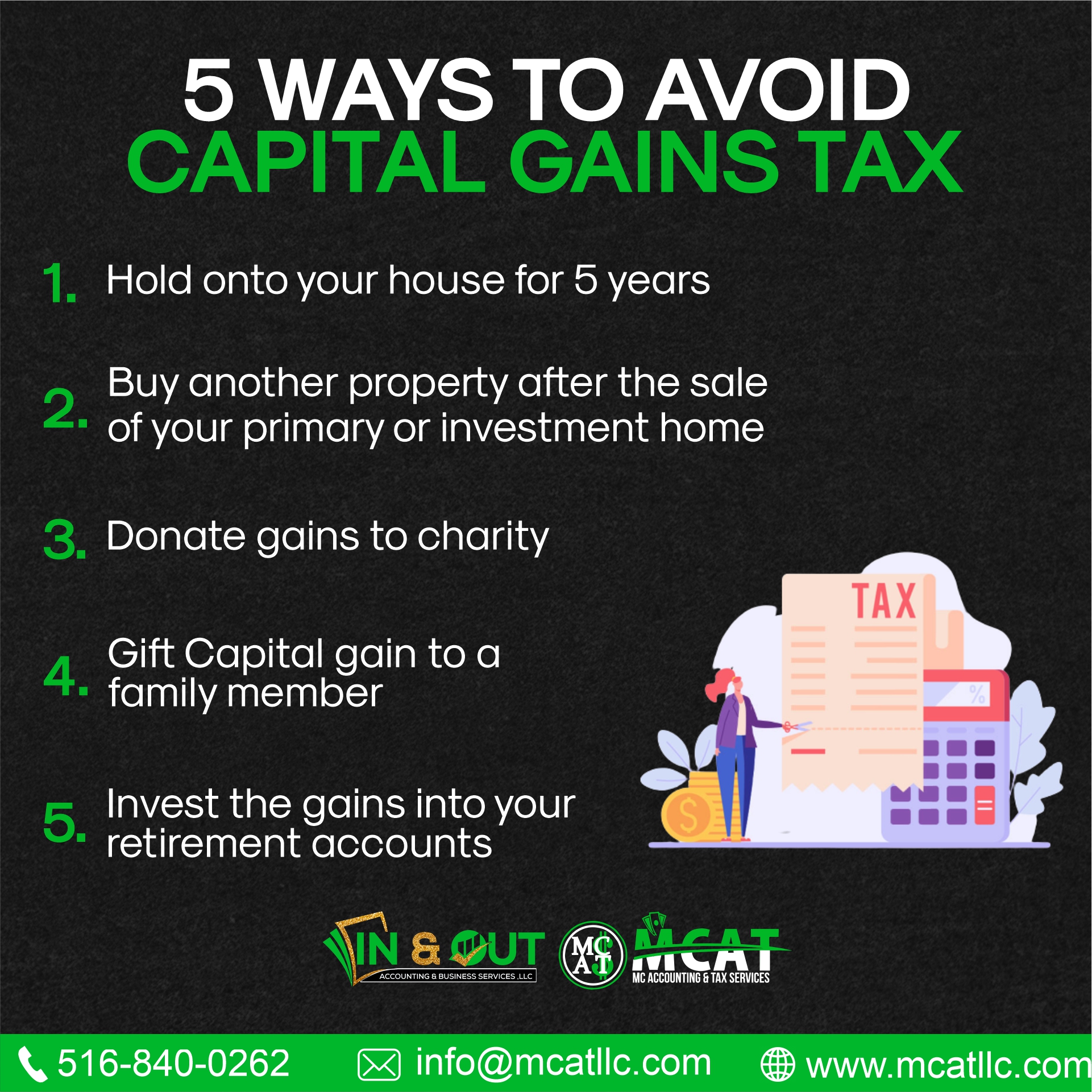

تويتر Ask Your Business Accounting Questions على تويتر If You Sold Stock Or Sold A House Recently That Profit Is Taxable By The Government Here Are A Few Strategies Recommended For Avoiding

Capital Gains Tax Low Incomes Tax Reform Group

How To Reduce Capital Gains Taxes In Canada Ontrack Accounting Bookkeeping

Capital Gain Tax Capital Acquisition Tax All4u Tax Services